Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website

通胀略高于预期,强化美联储限制性政策

FOMC 公布会议纪要

美联储于11日公布9月会议纪要,为了让通胀回落至2%目标,维持具有限制性的货币政策是关键,大多数与会者研判,未来的会议上可能适合再升息一次,而部分与会者则认定,没有必要进一步升息。会议纪要也点出,美国经济以稳定的步伐扩张,劳动市场逐渐达到平衡,不过通胀仍持续高于美联储目标,美联储官员预估,经济成长必须降至1.8%以下,才能让物价上涨的趋势缓和。

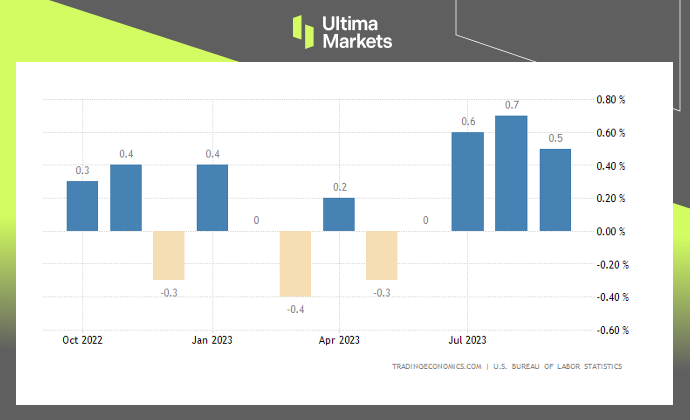

生产者物价月增 0.5%

美国劳工统计局同时公布通膨数据,由于汽油成本大涨5.4%,带动商品价格上涨0.9%,9月美国生产者物价环比上涨0.5%,为三个月来最低水平,8 月上涨0.7%,但高于市场预测的0.3%。

(PPI生产者物价 MoM,美国劳工统计局)

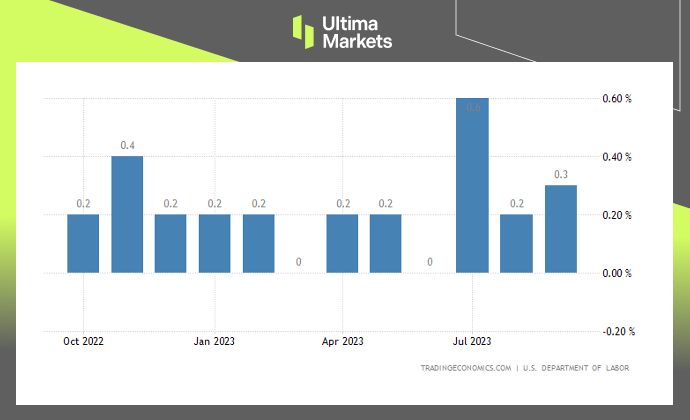

核心生产者物价月增0.3%

9月美国核心生产者物价月增0.3%,继上月上涨0.2%后,略高于市场预期的0.2%涨幅。就年增率计算,核心消费者物价上涨2.7%,8 月上涨2.5%,超过市场预期的2.3%,这可能促使美联储在较长时间内维持高利率。

(Core PPI核心生产者物价 MoM,美国劳工统计局)

国债收益率攀升可能降低升息预期

联邦公开市场委员会(FOMC)已经11次上调基准利率,使其达到5.25%至5.5%的目标区间,为22年来新高。近期国债收益率不断高,上一次会议后更是加速攀升。如果情况持续,收益率的走升可能消除再度加息的必要性。

免责声明

本文所含评论、新闻、研究、分析、价格及其他资料只能视作一般市场资讯,仅为协助读者了解市场形势而提供,并不构成投资建议。 Ultima Markets已采取合理措施确保资料的准确性,但不能保证资料的精确度,及可随时更改而毋须作出通知。 Ultima Markets不会为直接或间接使用或依赖此等资料而可能引致的任何亏损或损失(包括但不限于任何盈利的损失)负责。

随时随地观察市场动态

市场易受供求关系变化的影响

对关注价格波动的投资者极具吸引力

流动性兼顾深度与多元化,无隐藏费用

无对赌模式,不重新报价

通过 Equinix NY4 服务器实现指令快速执行