Understanding the Surprising Rise in U.S. Inflation Data

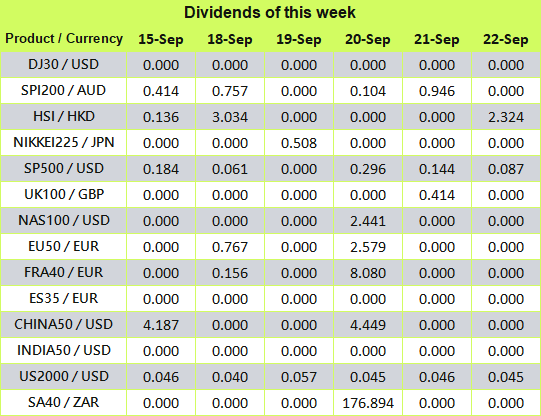

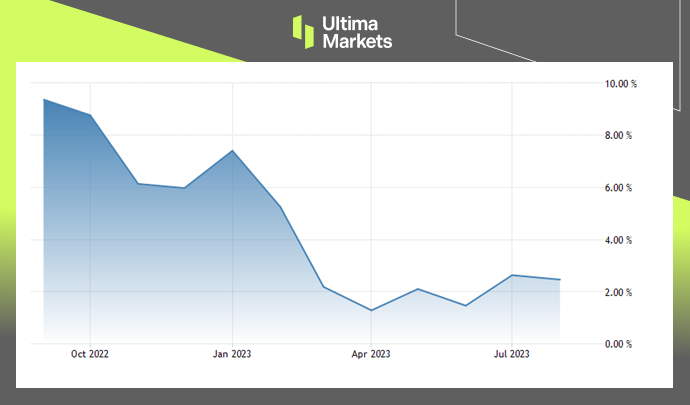

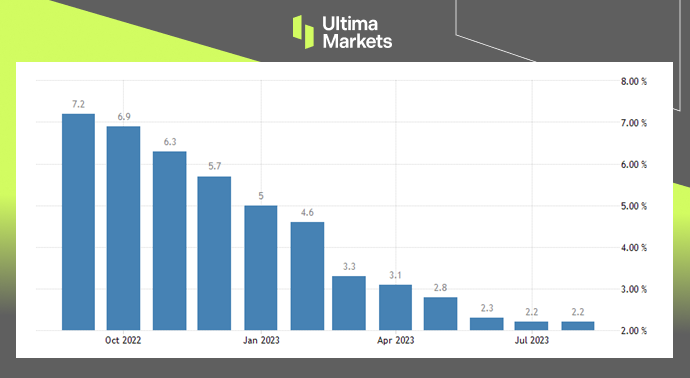

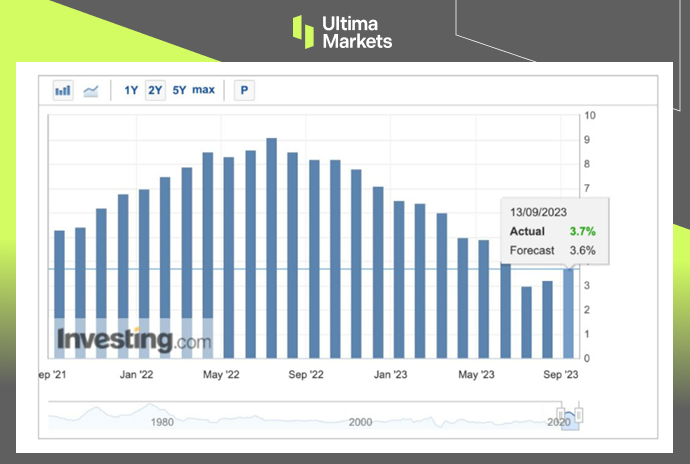

On September 13th, the U.S. Department of Labor (BLS) released the Consumer Price Index (CPI) in August increased by 3.7% year-on-year, slightly higher than the market estimate of 3.6%, and higher than the previous value of 3.2%.

However, excluding food and energy Core CPI increased by 4.3% YoY, in line with market expectations and lower than the previous value of 4.7%. It was the smallest increase in the past two years, but it was still higher than the Fed’s 2% target.

(U.S. Consumer Price Index CPI)

Understanding the Drivers

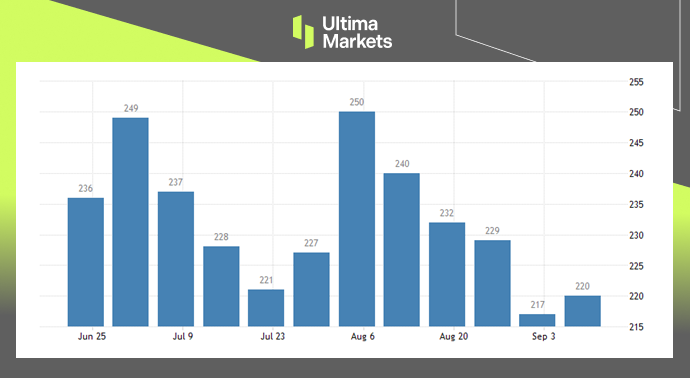

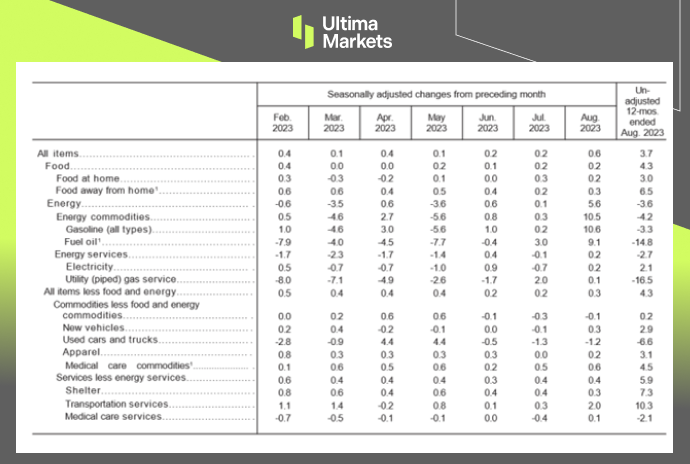

Examining the report details, energy was the main driver for the growth of CPI in August, accounting for more than half of the CPI increase. On a monthly basis, the growth rate of 5.6% was much higher than the 0.1% growth rate last month.

Separately, on an annual basis, housing prices increased by 7.3% in August, accounting for more than 70% of core CPI. However, the housing inflation rate is falling sharply, and the slowdown in growth has become more obvious.

In August, transportation (10.3%) beat housing for the first time and became the biggest driver of core CPI.

The production cuts by OPEC+ and the threat of strikes by the United Auto Workers against General Motors, Ford and Stellantis are all creating variables in the fight against inflation.

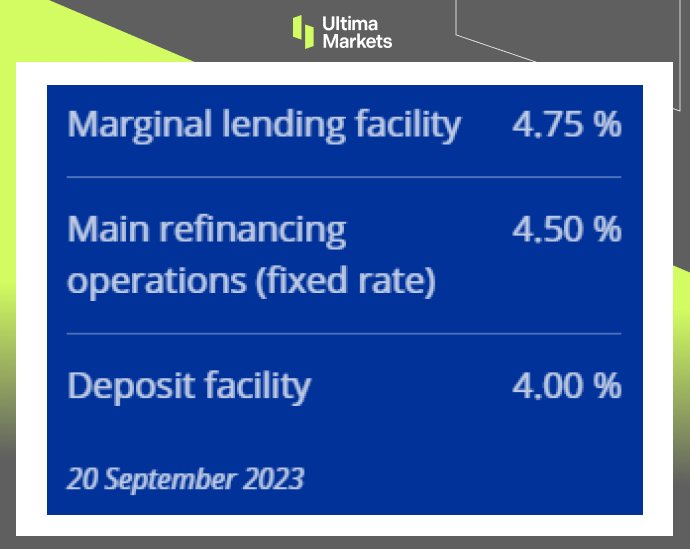

Implications for Monetary Policy

This CPI report is the last important economic data to be seen before the Fed’s monetary policy meeting next week.

CME Group The FedWatch Tool shows that the interest rate futures market predicts a 97% chance of keeping interest rates unchanged next week and only a 3% chance of raising interest rates by 25 bps.

However, the chances of keeping interest rates unchanged and raising interest rates by 1% at the November meeting are respectively 60% and nearly 40%.

(Detailed classification MoM % & YoY%, US BUREAU OF LABOR STATISTICS )

Conclusion

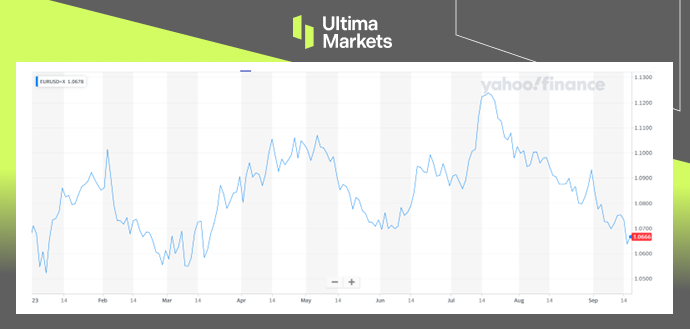

In summary, the unanticipated rise in U.S. inflation data for August 2023 raises critical questions and concerns.

As we explore the drivers behind this increase and the potential impact on monetary policy, it is evident that the economic landscape is evolving rapidly.

Market participants and policymakers must remain vigilant and adaptable in the face of dynamic conditions.

The coming months promise to be pivotal as we witness the Federal Reserve’s response to these unforeseen developments and their broader economic implications.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.