The Bitcoin ETF Hype

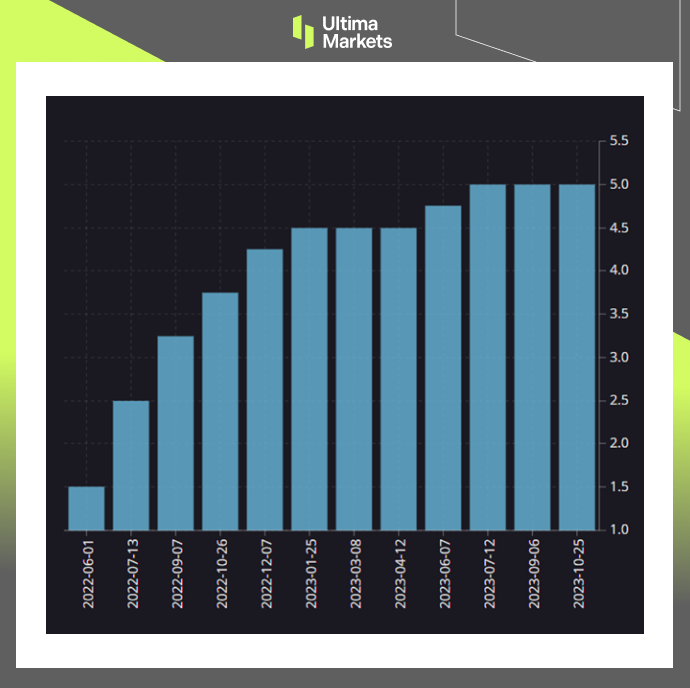

In October, cryptocurrency prices increased significantly, especially for bitcoin. Bitcoin had its biggest monthly hike since January.

Investors were excited about the possibility that bitcoin exchange-traded funds (ETFs) may soon be approved in the United States. ETF offers easy and affordable access for the average investor as compared to investing in cryptocurrency itself or existing products.

The Bitcoin ETF Revolution

Simplifying Crypto Investments

Bitcoin ETFs, once approved, have the power to reshape the way individuals engage with cryptocurrencies. They present a user-friendly and cost-effective means for the average investor to participate in the digital asset realm.

Unlike the traditional method of direct cryptocurrency investment, which can be complex and intimidating, Bitcoin ETFs provide a structured and approachable entry point.

Mainstream Legitimacy

The impending approval of Bitcoin ETFs heralds a new era of legitimacy for cryptocurrencies. These ETFs bridge the gap between traditional financial markets and the crypto space, bringing credibility to the forefront. With the backing of mainstream financial institutions, Bitcoin’s status as a viable investment asset is reinforced.

The Ripple Effect

Broad Market Growth for Bitcoin

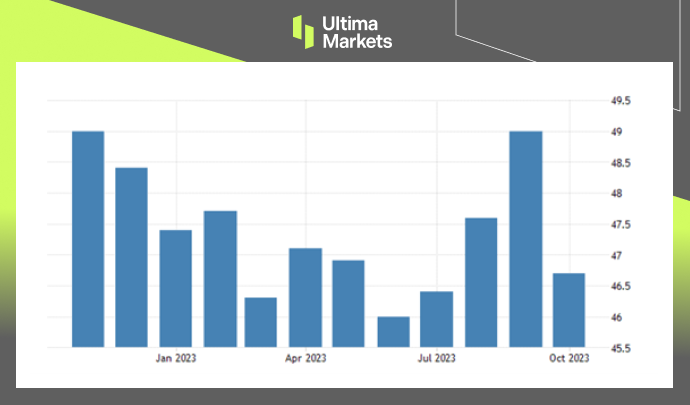

The surge in Bitcoin’s price triggered a ripple effect throughout the cryptocurrency market. The CoinDesk Market Index (CMI), tracking various tokens, recorded an impressive 22% growth during October. This upswing signifies a prevailing bullish sentiment, injecting confidence into the crypto landscape.

Bitcoin Market Capitalization Soars

TradingView data reveals that the total market capitalization of all cryptocurrencies soared by nearly 19%, reaching a substantial $1.255 trillion. This surge represents the most significant increase in crypto wealth since January, underlining the market’s resilience and growth potential.

(BTCUSD One-month Chart)

Bitcoin’s Outstanding Performance

Bitcoin’s Ascendancy

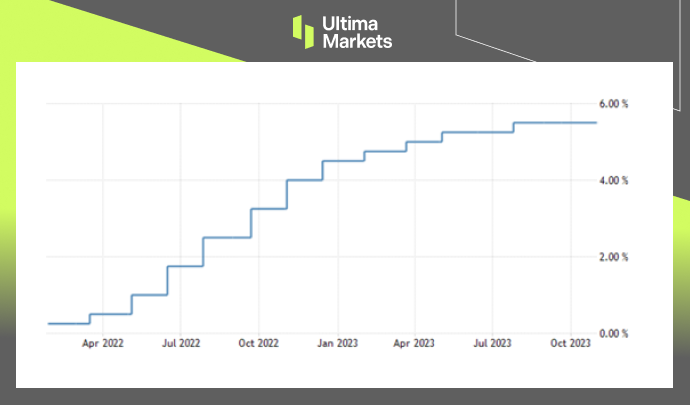

Bitcoin (BTC), the pioneer of cryptocurrencies, outperformed its peers during this remarkable rally. BTC advanced by more than 27%, achieving a 17-month high of $35,000. This surge followed a period during which it traded around $27,000 in the early weeks of October. Currently, Bitcoin maintains its position above $34,000, as investors eagerly await the Federal Reserve’s interest rate decision.

Confidence in Bitcoin

Bitcoin’s impressive performance during this surge underscores its appeal to investors worldwide. Its stability above $34,000 signals growing confidence in Bitcoin as a long-term store of value and investment asset.

Conclusion

The surge of Bitcoin in October 2023 was nothing short of phenomenal, fueled by the prospects of Bitcoin ETF approval in the United States. This surge not only transformed Bitcoin but had a cascading effect on the broader cryptocurrency market. It showcased resilience, promise, and Bitcoin’s enduring position as a prominent player in the digital asset landscape.

The cryptocurrency market is still changing as time goes on. The forthcoming introduction of Bitcoin ETFs into traditional financial markets marks a significant turning point, providing investors of all stripes with accessibility, legitimacy, and a wide range of investment options.