Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website

Employment Stays Viable as Australia’s Manufacturing Sector Remains Sluggish

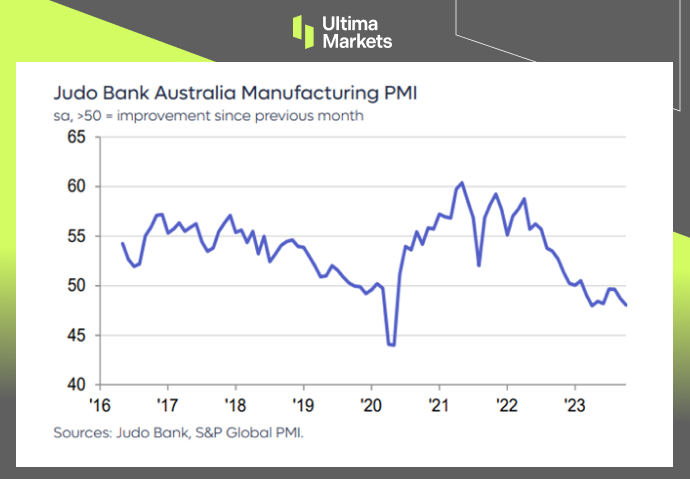

Manufacturing PMI Hit Lowest Level in Six Months

The Judo Bank Flash Australia Manufacturing PMI experienced a decline to 48 during the month of October 2023, down from 48.7 in the preceding month, according to preliminary data. This marks the eighth consecutive monthly decline in business conditions and represents the lowest reading in 6 months, primarily attributed to decreased production and diminished new order volumes in response to weakened demand. Input expenses witnessed a notable surge, driven by mounting inflationary pressures reaching a peak not seen in 7 months. Escalating fuel expenses emerged as one of the principal factors contributing to the upward pricing pressure. Although output charges also rose, the pace of increase was comparatively slower. Given the deteriorating market conditions, business sentiment declined to its lowest level in three and a half years. Encouragingly, employment levels sustained growth, thereby extending the ongoing streak of job creation for a duration of 3 years.

(Judo Bank Australia Manufacturing PMI,S&P Global)

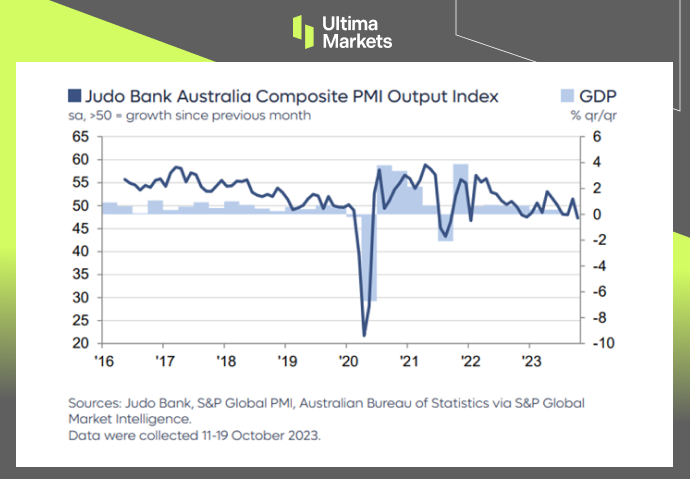

Composite PMI in Contractionary Shadow

The Judo Bank Flash Australia Composite PMI dropped to 47.3 during October 2023, plunging from 51.5 in the preceding month, as per preliminary findings. This figure represents the lowest reading observed over a span of 21 months, driven by a substantial decline in operational performance across Australia’s private sector. The downturn in business activity stemmed from a reduction in incoming orders, an unfavorable demand climate, mounting inflationary pressures, and elevated interest rates. The volume of new export business experienced a decline for the eighth consecutive month. Input costs continued their rapid advancement, stimulated by rising inflation that reached a 3-month high. Output prices exhibited an increase as well, albeit weakened customer demand exerted pressure on pricing capabilities, resulting in the slowest pace of charge inflation since March 2021.

(The Judo Bank Flash Australia Composite PMI,S&P Global)

Perché fare trading su metalli e materie prime con Ultima Markets?

Ultima Markets offre il più competitivo ambiente di costi e scambi per le materie prime più diffuse in tutto il mondo.

Inizia a fare tradingMonitoraggio del mercato in movimento

I mercati sono sensibili ai cambiamenti della domanda e dell'offerta

Attraente per gli investitori interessati solo alla speculazione sui prezzi

Liquidità ampia e diversificata senza commissioni nascoste

Nessun Dealing Desk e nessuna riquotazione

Esecuzione rapida tramite il server Equinix NY4