Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website1 July 2024

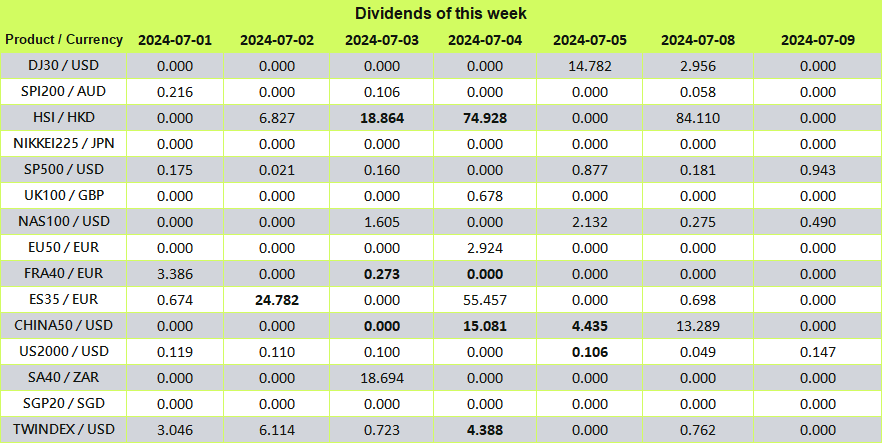

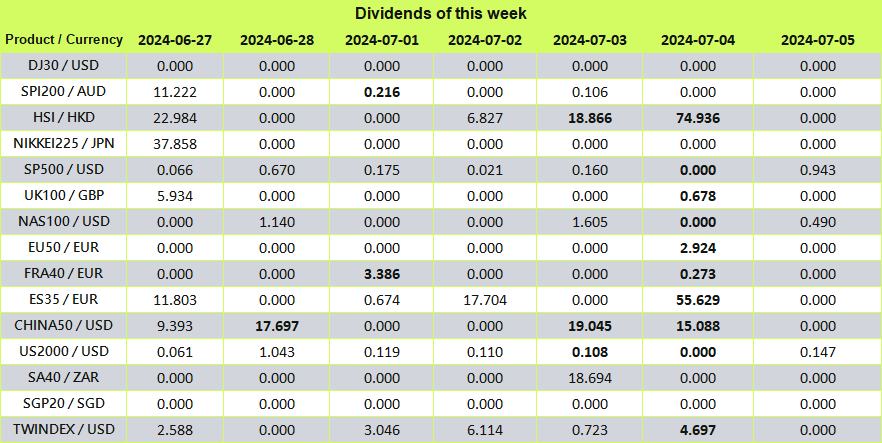

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

28 June 2024

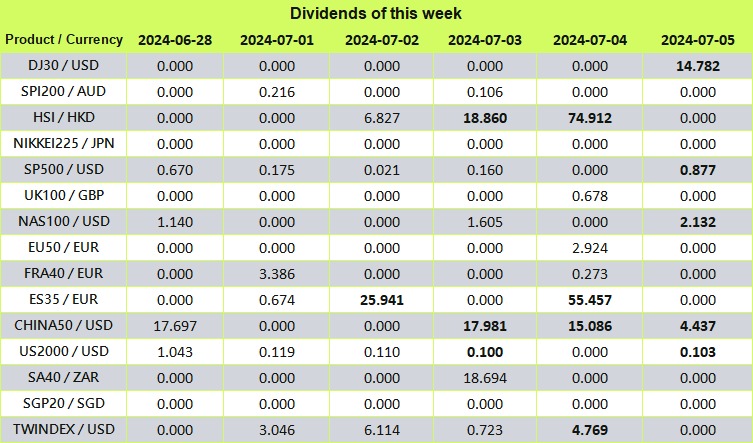

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

28 June 2024

Ultima Markets2024年7月のCFDロールオーバー期日について

2024年7月のCFDロールオーバー期日について

|

シンボル |

銘柄 |

ロールオーバー期日 |

現行契約 |

次期契約 |

|---|---|---|---|---|

VIX |

ボラティリティ指数 |

2024-07-15 |

2024年7月 |

2024年8月 |

CL-OIL |

原油先物 |

2024-07-17 |

2024年8月 |

2024年9月 |

FRA40ft |

FRA40 先物 |

2024-07-18 |

2024年7月 |

2024年8月 |

UKOUSDft |

ブレント原油先物 |

2024-07-24 |

2024年9月 |

2024年10月 |

CHINA50ft |

CHINA50 先物 |

2024-07-25 |

2024年7月 |

2024年8月 |

HK50ft |

HK50 先物 |

2024-07-26 |

2024年7月 |

2024年8月 |

• ロールオーバーの前後30分間は資金の口座間移動はできません。

•ロールオーバーの前に、ポジションをご確認いただき、指値や逆指値を設定していただくことをお勧めいたします。

• リクイディティプロバイダーは、市場状況の変化に応じてロールオーバースケジュールを調整する場合があります。

最新の実行データについては、MetaTraderのソフトやアプリケーションの情報をご確認ください。

ご不明な点がございましたら、[email protected]までお気軽にお問い合わせください。

27 June 2024

Ultima Markets Index Dividend Adjustment Notice

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected]

27 June 2024

Ultima Markets 2024年7月祝日のお取引時間についてのお知らせ

| 祝日 | 日付 | 調整内容(商品/アクション) | |

| 香港特別行政区設立の日 | 2024年7月1日 | 閉場 | HKTECH, USDCOP |

| HK50, HK50ft | |||

| 国王公式誕生日 | 2024年7月3日 | 20:00 通常より早い閉場 | US shares |

| 20:15 通常より早い閉場 | VIX, DJ30, DJ30ft, SP500, SP500ft,NAS100,NAS100ft, US2000, Nikkei225,JPN225ft |

||

| 23:00 通常より早い閉場 | UK100, UK100ft GER40, GER40ft |

||

| 独立記念日 | 2024年7月4日 | 閉場 | Cotton, OJ, Cocoa, Coffee, Sugar,Soybean,Wheat |

| 閉場 | US shares | ||

| 17:00 通常より早い閉場 | XPDUSD, XPTUSD | ||

| 18:30 通常より早い閉場 | VIX | ||

| 20:00 通常より早い閉場 | DJ30, DJ30ft, SP500, SP500ft, NAS100,NAS100ft, US2000, Nikkei225,JPN225ft.USNote10Y. |

||

| 20:15 通常より早い閉場 | GOLD, SILVER.UKOUSD, UKOUSDft, USOUSD, CL-OIL |

||

| 20:30 通常より早い閉場 | Gasoil | ||

| 21:30 通常より早い閉場 | NG, GAS, Copper | ||

| 23:00 通常より早い閉場 | UK100, UK100ft GER40, GER40ft |

||

| 独立記念日 | 2024年7月5日 | 03:00 通常より遅い開場 | UKOUSDft |

| 15:00 通常より遅い開場 | Cotton | ||

| カーメル山の聖母の日 | 2024年7月16日 | 閉場 | USDCLP |

| イスラム教新年 | 2024年7月17日 | 閉場 | USDINR |

お知らせ

- • 記載の時間は、DST システム時間の GMT+3 に基づいています。

- • リクイディティプロバイダーは、市場状況の動的な性質に基づいて取引セッションを調整する場合がございます。

最新の実行データについては、MetaTraderのソフトやアプリケーションの情報をご確認ください。

ご不明な点がございましたら、 [email protected]までお気軽にお問い合わせください。

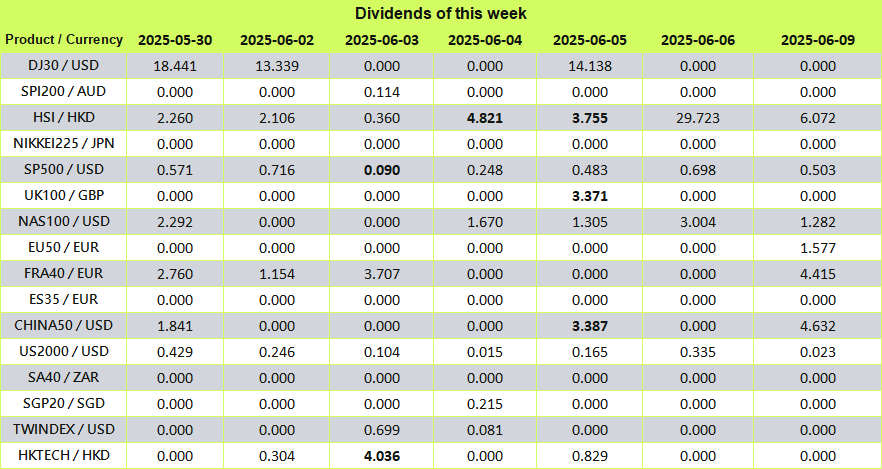

Ultima Markets Index Dividend Adjustment Notice

Filters:

No Results

Please try a different search term.

• The above data are expressed in the base currency of each index.

• According to market practice, the actual execution data may change, please refer to MT4 software for details.

When the stock index goes ex-dividend, the dividend will be adjusted in the form of fund deduction.

You can view the fund deduction record with the following annotation “Div & stock index name & net lot” in the account history,It is the dividend adjustment. The long lot is calculated as a “positive value”, and the short lot is calculated as a “negative value”. The sum of the two is the “net lot”.

An example is as follows.

If you trade more than 5 lots of DJ30, you can view the “Div & DJ30 & 5” dividend adjustment record in the form of balance in the account history; View the “Div & DJ30 & -5” dividend adjustment records in the form of balance.

We recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected]