25 April 2024

美元今日或同資料起,歐央行6月將降息

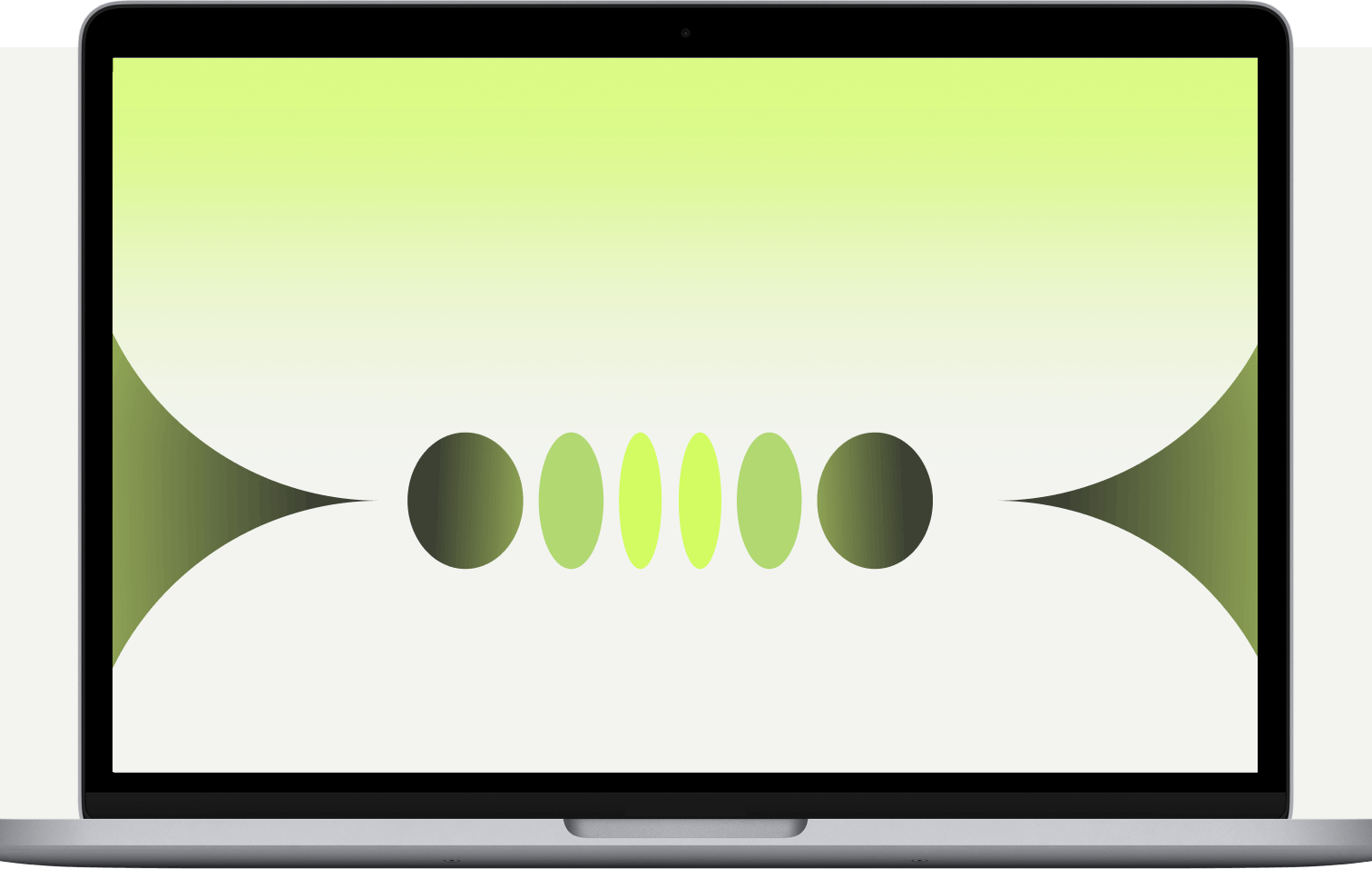

今日Ultima Markets 為您帶來了 2024年 4月 25日歐元兌美元的深入分析。 基本面要點 美國第一季度資料:今日美國將公佈最新的第一季度GDP和PCE資料。今年的通膨資料持續超出預期,同時ISM的PMI指數也再次突破榮枯線50,這些都暗示了美國仍處於通膨上行的壓力下。今夜資料若明確了這一觀點,則年內加息概率進一步降低,而美元指數或乘勢上行。 歐央行明確降息:歐洲央行已基本承諾將在下次政策會議上降息,但決策者們仍在討論降息後的利率走勢。歐洲央行管委內格爾週三表示,歐元區的通膨仍可能比較頑固,因此6月降息後不一定會採取進一步的寬鬆政策。這個既要也要的措辭讓歐元兌美元陷入糾結,因此市場未來焦點於後續經濟資料能否支援歐央行繼續放寬政策。 技術分析 日線圖表分析 (歐元兌美元日線圖,來源Ultima Markets MT4) 隨機震盪指標:指標未進入超賣區域就發出多頭信號,配合匯價趨勢來看短期場外空頭機構仍在觀望,警惕指標在即將接近50中位線附近後再度發出空頭信號。 上方阻力價位:匯價整體仍處於長期趨勢線200日均線(綠色)下方,歐元相對于美元仍處於貶值壓力。亞盤即將接近前期匯價跌破的支撐價位1.07240,該價位也是紅色33日均線附近。 1小時圖表分析 (歐元兌美元1小時圖,來源Ultima Markets MT4) 隨機震盪指標:指標發出多頭信號後緩慢上行,配合匯價來看,當前趨勢大概率為反彈調整結構。但價格若快速突破昨日高點,則需警惕多頭趨勢或再度來臨。 均線支撐:歐元兌美元昨日突破綠色200週期均線後,回踩均線組繼續反彈上行。三條均線組的糾纏暗示當前匯價迎來關鍵的趨勢方向決策。若突破昨日高點則典型的123回踩交易策略出現;若亞盤反彈不過高點,轉向下破均線組則新的下跌趨勢來臨。 Trading Central樞紐線指標 (歐元兌美元30分鐘圖,來源Ultima Markets APP) 根據Ultima Markets APP中的Trading Central樞紐線指標,當日中樞價位1.0715, 1.0715之上看漲,第一目標1.0730,第二目標1.0745 1.0715之下看跌,第一目標1.0680,第二目標1.0665 免責聲明 本文所含評論、新聞、研究、分析、價格及其他資料只能視作一般市場資訊,僅為協助讀者瞭解市場形勢而提供,並不構成投資建議。Ultima Markets已採取合理措施確保資料的準確性,但不能保證資料的精確度,及可隨時更改而毋須作出通知。Ultima Markets不會為直接或間接使用或依賴此等資料而可能引致的任何虧損或損失(包括但不限於任何盈利的損失)負責。