Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteZoom Soars Above Expectations, Trading Higher in 3Q Triumph

Zoom Video Communications: A Comprehensive Analysis of 3Q Performance and Future Projections

Explore Zoom’s impressive third-quarter results, where it surpassed revenue and earnings projections. Zoom’s CEO, Eric S. Yuan, highlights the role of innovative features like the Zoom AI Companion in the company’s growth.

Learn about the enterprise segment’s substantial contribution, the outlook for the current quarter, and why Zoom’s stock is on the rise.

Zoom Raised Guidance on Improving Enterprise Base

Releasing its third-quarter financial results, Zoom (ZM.US), the well-known video conferencing business, surpassed market forecasts and gained momentum. The quarter’s overall revenue of $1.14 billion demonstrated a 3.2% year-over-year growth and above the $1.12 billion forecast.

Adjusted earnings per share, which were $1.29 as opposed to the projected $1.10 per share, further demonstrated the outstanding performance.

Enterprise Growth and Revenue Breakdown

A significant driver of Zoom’s success was the enterprise segment, witnessing an impressive 7.5% YoY surge in revenue, totaling $660.6 million. In contrast, the online revenue segment experienced a marginal decline of 2.4%.

This robust growth underscores Zoom’s prowess in catering to the evolving needs of the business landscape.

Insights from CEO Eric S. Yuan

Zoom’s CEO, Eric S. Yuan, expressed his satisfaction with the third-quarter outcomes, emphasizing the company’s commitment to innovation.

He attributed the revenue outperformance to the strategic enhancement of Zoom’s intelligent collaboration platform, featuring groundbreaking elements such as the Zoom AI Companion.

Additionally, Yuan highlighted advancements in customer and employee engagement solutions, contributing to improved customer retention and increased utilization of new AI capabilities.

Forward-Looking Projections

Peering into the current quarter, Zoom projects total revenue ranging from $1.125 billion to $1.130 billion, coupled with earnings per share between $1.13 and $1.15. These figures surpass analysts’ expectations, demonstrating Zoom’s optimistic outlook.

For the full fiscal year, the company anticipates total revenue between $4.506 billion and $4.511 billion, with an expected EPS range of $4.93 to $4.95.

Market Response and Stock Performance

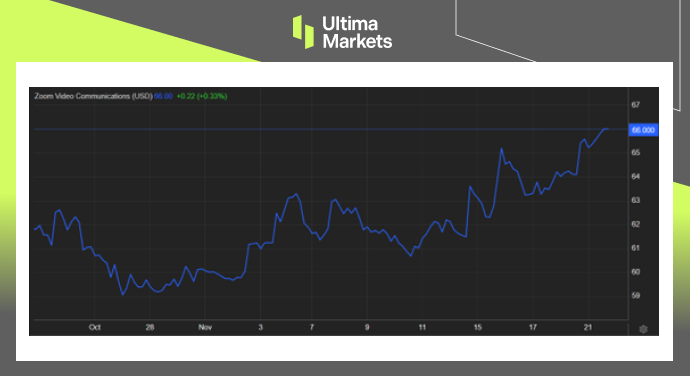

Post-announcement, Zoom experienced a notable uptick, trading higher with a 2.93% gain. Over the past four weeks, the stock price has demonstrated remarkable resilience, registering a substantial 7.97% increase.

(Zoom Stock Performance One-month Chart)

Bottom Line

In conclusion, Zoom’s stellar performance in the third quarter, coupled with optimistic projections, positions the company as a frontrunner in the dynamic landscape of video communications.

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

ki การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4