Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteHome Depot Shares Surge on Remarkable Earnings Triumph

Home Depot’s Strong Q3 2023 Performance

Home Depot (HD.US), the world’s largest home improvement specialty retailer, has experienced a significant boost in sales during the third quarter of 2023. This surge can be attributed to increased customer spending on repair work and small renovation projects.

The company’s revenue of $37.71 billion has slightly exceeded the anticipated $37.70 billion, showcasing a robust financial performance.

Home Depot’s Financial Overview

Earnings per share, on an adjusted basis, stood at $3.81, surpassing the forecast of $3.76. Despite a recent trend of declining same-store sales, Home Depot remains resilient in the face of challenges. The company projects a modest 3% to 4% drop in the current quarter, narrowing its previous forecast.

Increased interest rates, especially for mortgages, have affected the number of homes being built. According to government data, the number of home starts during the first nine months of this year was 12% lower than it was during the same time last year.

Home Depot’s Strategic Guidance

Richard McPhail, the CFO of Home Depot, noted that the current year represents a period of moderation in home improvement. However, he emphasized that Home Depot’s customers are financially sound, with income gains and wealth gains in recent years, along with excess savings. Despite the moderation, customers remain engaged in home improvement activities.

Fiscal Year 2023 Forecast

Home Depot has revised its guidance for the fiscal year 2023.

The earlier estimate of a 2% to 5% fall in revenue is revised to a prediction of a 3% to 4% decline compared to fiscal year 2022. The prior projection range of 7% to 13% now stands at a fall of 9% to 11% year over year for adjusted earnings per share.

A cash dividend of $2.09 per share for the third quarter has been issued by the corporation.

Stock Performance and Market Trends

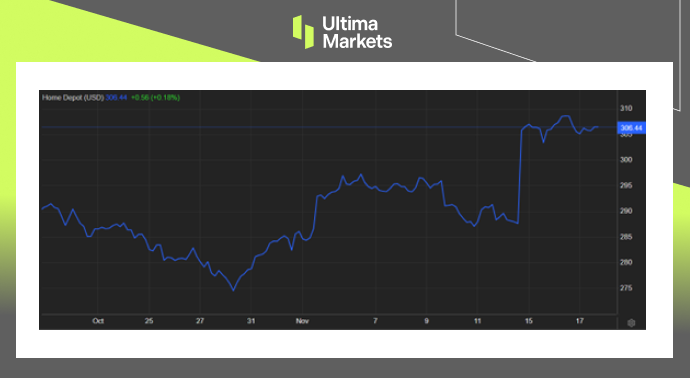

Despite a roughly 9% decline in Home Depot’s stock performance compared to the S&P 500 index this year, the company has experienced an upward trend, fueled by a broad-market rally.

Home Depot’s stock remains an intriguing option for investors, considering its historical strength in the home improvement retail sector.

(Home Depot Stock Performance One-month Chart)

Bottom Line

In conclusion, Home Depot’s Q3 2023 performance reflects its resilience in the face of challenges, offering investors a nuanced perspective on the home improvement retail sector.

Explore the intricate details of Home Depot’s financials, stock performance, and market trends to make informed investment decisions.

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

ki การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4