Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this websiteFocus on USDX Today – 26th Sep 2023

Comprehensive USDX Analysis for September 26, 2023

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the USDX for 26th September 2023

Key Takeaways

The Federal Reserve’s stance has emerged as the linchpin shaping the USDX’s performance.

While September saw a halt in interest rate hikes, the dot plot projections signal a potential resurgence in rate increases later in the year.

This is underpinned by a forthcoming, more hawkish monetary policy in the next year, with a notable reduction in the number of projected interest rate cuts.

USDX Technical Analysis

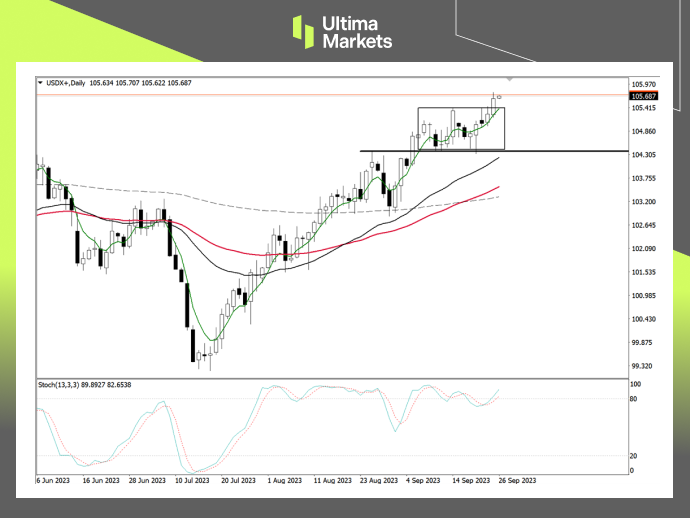

USDX Daily Chart Insights

( Daily chart of USDX, source: Ultima Markets MT4)

Turning our focus to the technical landscape, the USDX exhibits compelling upward momentum.

The daily chart reveals a breakthrough as the US Dollar Index’s price closes above its consolidation range’s upper boundary.

Moreover, the stochastic oscillator, a pivotal technical indicator, has signaled a bullish trajectory.

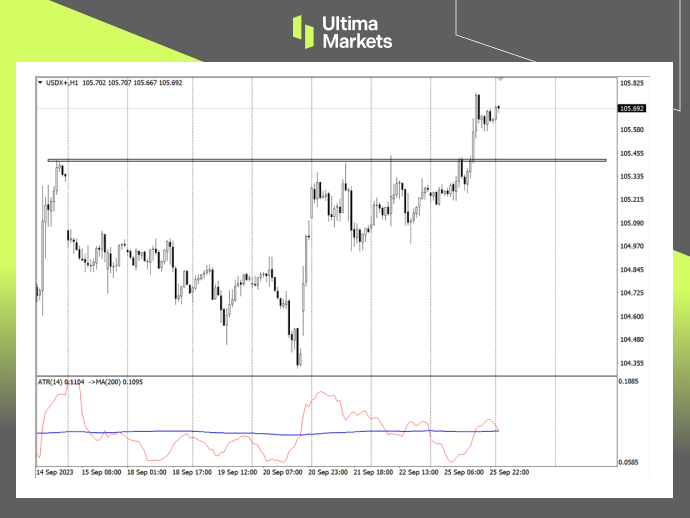

USDX 1-Hour Chart Analysis

(1-hour chart of USDX, source: Ultima Markets MT4)

The one-hour chart presents a more granular picture, with the ATR combination indicator affirming the effectiveness of the recent breakthrough.

Although retracement is conceivable during the Asian trading session, a market rebound is anticipated. The initial target is fixed at the support price of 105.443.

Ultima Markets Pivot Indicator

(1-hour chart of USDX, source: Ultima Markets MT4)

Ultima Market’s MT4 pivot indicator designates the day’s central price at 105.527. For investors and traders, here are the essential projections:

Bullish Scenario:

- Bullish above 105.527

- First target: 105.874

- Second target: 106.123

Bearish Scenario:

- Bearish below 105.527

- First target: 105.282

- Second target: 104.937

These projections, though subject to market dynamics and emerging data, provide a compass for navigating the ever-evolving terrain of financial markets.

Conclusion

Vì sao chọn giao dịch Kim loại & Hàng hóa với Ultima Markets?

Ultima Markets cung cấp điều kiện giao dịch và chi phí cạnh tranh hàng đầu cho các mặt hàng phổ biến trên toàn thế giới.

Bắt đầu giao dịchTheo dõi thị trường mọi lúc mọi nơi

Thị trường dễ bị ảnh hưởng bởi những thay đổi về cung và cầu

Hấp dẫn với các nhà đầu tư chỉ quan tâm đến đầu cơ giá

Thanh khoản sâu và đa dạng, không có phí ẩn

Không qua môi giới tạo lập thị trương, không báo giá lại

Khớp lệnh nhanh chóng thông qua máy chủ Equinix NY4