Record High DAX Index, Improved Economic Data and Rate Cuts

Written on December 7, 2023 at 11:50 am

Ultima Markets Index Dividend Adjustment Notice

Written on December 6, 2023 at 2:02 pm

Focus on BRENT OIL Today – 6th December 2023

Written on December 6, 2023 at 1:37 pm

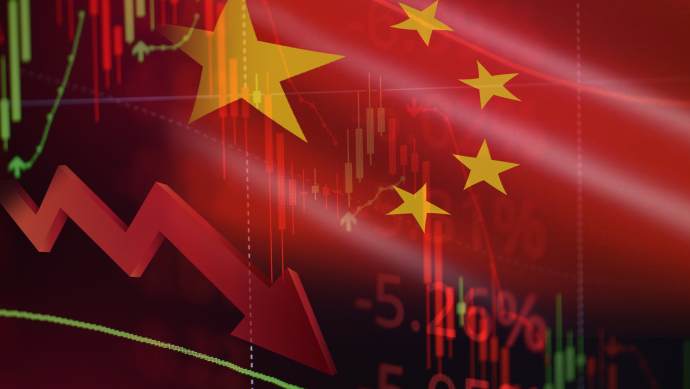

Moody’s Lowers China Credit Outlook Amid Debt and Challenges

Written on December 6, 2023 at 1:10 pm

Ultima Markets Index Dividend Adjustment Notice

Written on December 5, 2023 at 1:52 pm

AUDUSD, Reserve Bank of Australia

Focus on AUD/USD Today – 5th December 2023

Written on December 5, 2023 at 11:59 am

Europe Stocks Pauses: Investors Await Policy Hints

Written on December 5, 2023 at 11:36 am

Ultima Markets Index Dividend Adjustment Notice

Written on December 4, 2023 at 1:54 pm

ISM Manufacturing PMI Disappoints, Igniting Economic Alarms

Written on December 4, 2023 at 1:11 pm