Comprehensive GBP/NZD Analysis for October 4, 2023

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of GBP/NZD for 4th October 2023.

Key Insight: RBNZ Interest Rate Decision and Economic Outlook

- RBNZ Decision: The Reserve Bank of New Zealand (RBNZ) has opted to maintain the interest rate at 5.50%.

- Consistency: Notably, this marks the third consecutive time that the central bank has refrained from adjusting interest rates.

- GDP Growth: Despite a stronger-than-expected GDP growth in the June quarter, the overall growth outlook remains subdued.

- Global Economic Risks: The RBNZ Committee has expressed concerns about downside risks to the global economic growth outlook in the medium term.

- Short-Term Currency Trends: In the short term, the New Zealand dollar may face a depreciation trend.

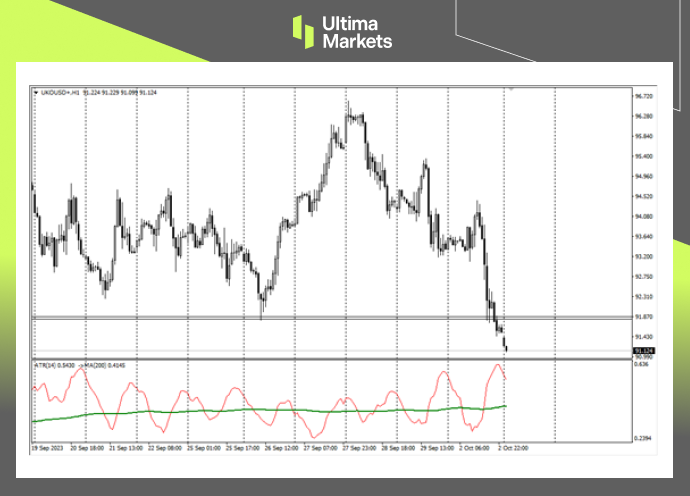

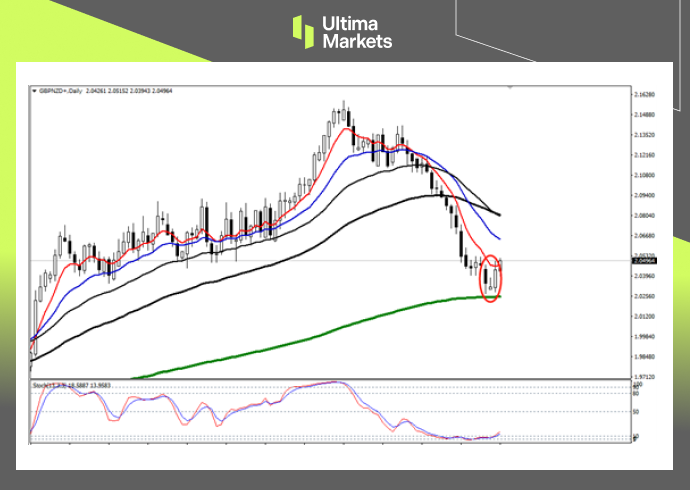

Technical Analysis: A Closer Look on GBP/NZD Trading Charts

GBP/NZD Daily Chart Insights

Reversal Structure: The daily chart illustrates a clear reversal structure, with the 240-day moving average acting as a significant resistance point.

( Daily chart of GBP/NZD, source: Ultima Markets MT4)

The stochastic oscillator technical indicator has also left the oversold area after being oversold for nearly 9 trading days. The market may continue to rebound and rise today.

GBP/NZD 4-Hour Chart Observations

- Motive Wave: A five-wave upward structure has emerged since the end of September, signaling a potential motive wave.

- Moving Average Test: The market has surged rapidly and is nearing the 65-period moving average, a level to monitor for potential breakout.

(4-hour chart of GBP/NZD, source: Ultima Markets MT4)

Pivot Indicator

(1-hour chart of GBP/NZD, source: Ultima Markets MT4)

Central Price: According to Ultima Markets MT4 pivot indicator, the central price for the day stands at 2.04099.

- Bullish Outlook: A price movement above 2.04099 could trigger an upward momentum, targeting 2.05336 as the first level of resistance and 2.06164 as the second.

- Bearish Outlook: A dip below 2.04099 may indicate a bearish trend, with the first support level at 2.03301 and the second at 2.02075.

Legal Documents

Ultima Markets, a trading name of Ultima Markets Ltd, is authorized and regulated by the Financial Services Commission “FSC” of Mauritius as an Investment Dealer (Full-Service Dealer, excluding Underwriting) (license No. GB 23201593). The registered office address: 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.