Gold Surges Past $2,000 Driven by Geopolitical Tensions

Israeli forces have begun their largest ground attack in Gaza so far in the war with Hamas, despite ongoing diplomatic efforts to delay an expected full ground invasion.

Fueled by hedge buying, Gold raised above $2,000 an ounce and marked the third straight weekly gain.

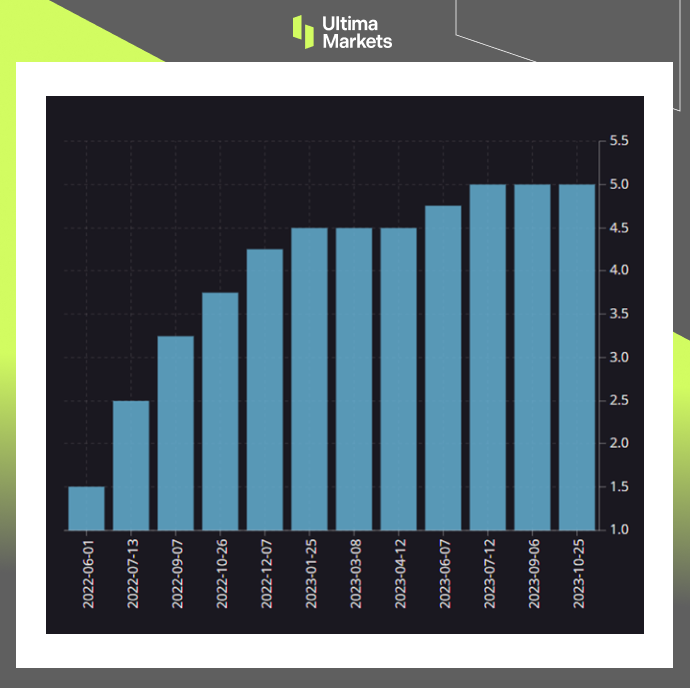

Gold is trading within a very steep ascending channel, which highlights not only the strength of the current rally but also the need for consolidation.

(Gold Price USD/Ounce)

The Gold Rally: A Closer Look

The Middle East’s developing geopolitical events, particularly the ongoing conflict between Israeli forces and Hamas, are primarily responsible for the recent spike in gold prices.

Israeli forces have launched their most extensive ground attack in Gaza to date, despite continuous diplomatic efforts to avert a full-scale ground invasion.

This significant escalation of hostilities has triggered a sharp increase in the demand for gold, predominantly driven by a surge in hedge buying.

Geopolitical Tensions: The Catalyst

The heightened geopolitical tensions have underscored the importance of gold as a safe-haven asset. During times of uncertainty and conflict, investors and institutions alike turn to gold as a reliable store of value.

The surge in gold prices reflects not only the current rally’s strength but also the market’s demand for a stable and secure asset amidst turmoil.

A Steep Ascending Channel

Gold’s impressive ascent is further emphasized by its trading within a steep ascending channel. This upward price trend signifies not only the robustness of the current gold rally but also the necessity for consolidation.

The ascending channel illustrates the market’s optimism regarding gold’s potential and its sustained upward trajectory.

Silver Softened, After Hitting a High

On the other hand, silver, a valuable metal often sought as a safe investment during uncertain times, received ongoing support due to the Middle East conflict.

Additionally, the prospects for increased industrial usage of silver were strengthened by additional stimulus measures implemented in China.

However, silver prices didn’t sustain strength, falling below $23.3 per ounce, following a recent peak on October 20th.

(Silver Price USD/Ounce)

Conclusion

The surge in gold prices, driven by geopolitical tensions in the Middle East, marks a pivotal moment in the precious metals market.

Gold’s status as a safe-haven asset has been reaffirmed, and its upward trajectory within a steep ascending channel suggests a continued bullish sentiment.

While silver also responded positively to global turmoil, its recent price decline highlights the complex dynamics within the precious metals market.

Stay tuned for more updates as we navigate these exciting developments in the world of precious metals.